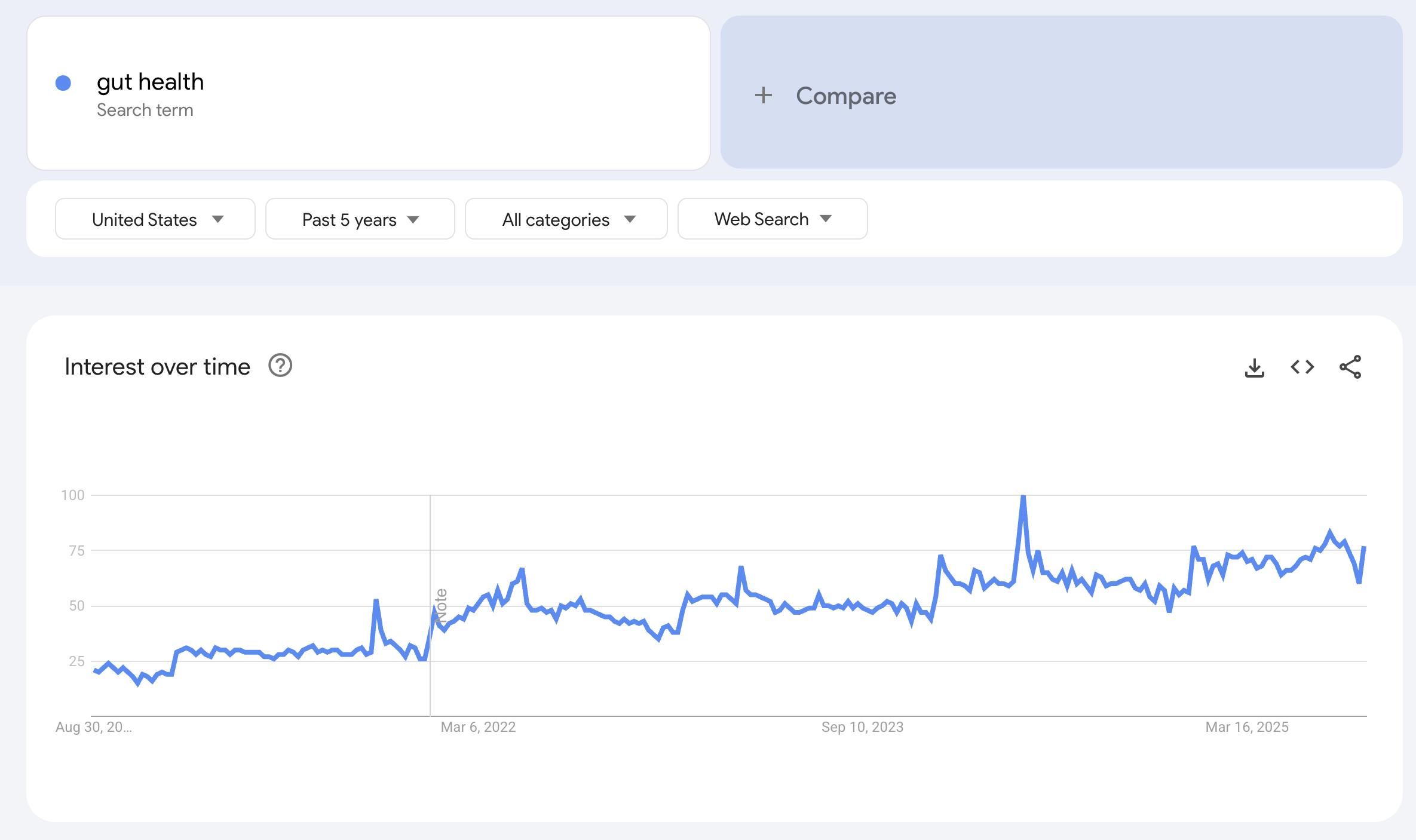

1. As a founder of a gut health tracking company,

I used to think gut health was the hottest health concern in the US, looking at Google Trends:

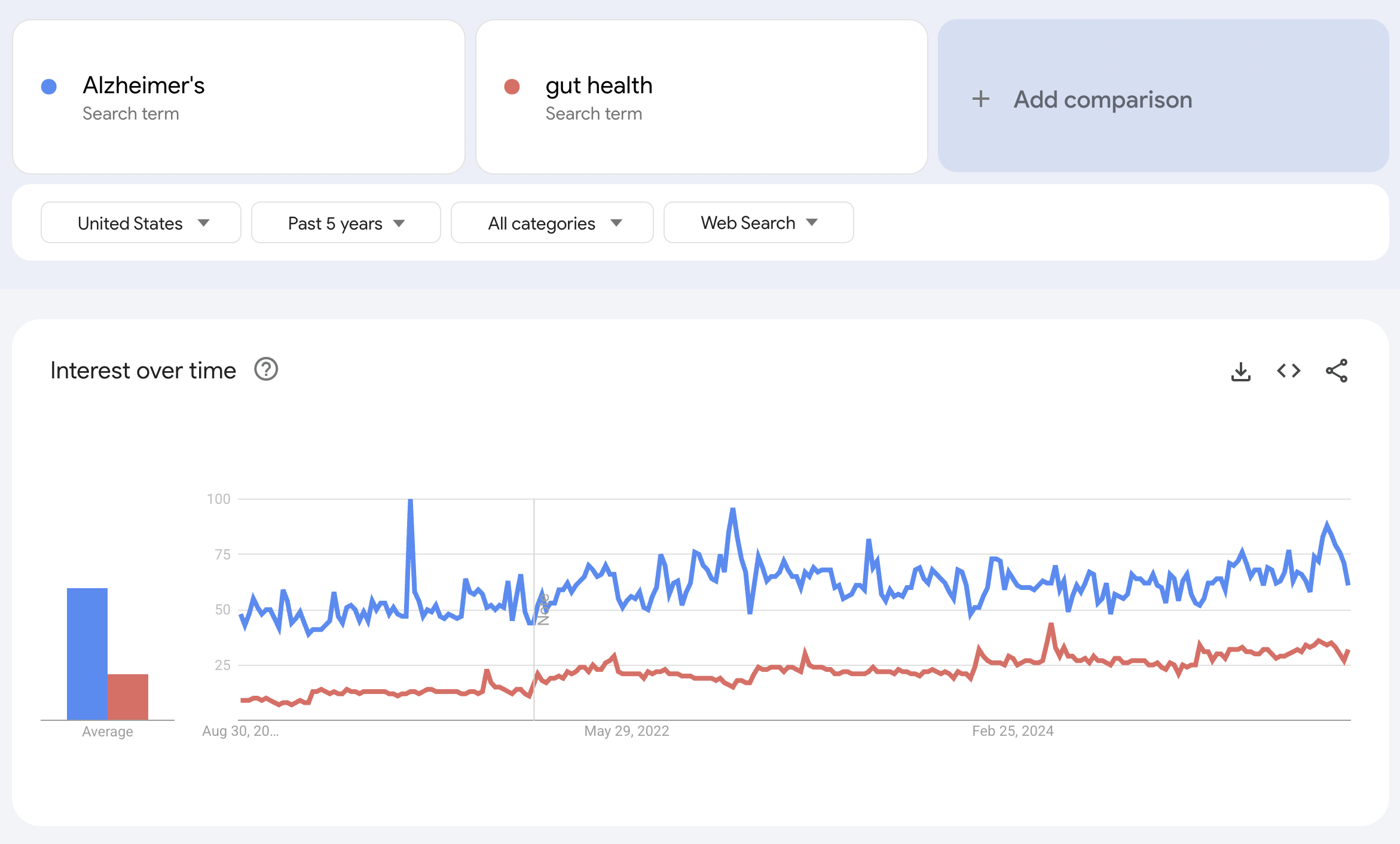

Until I compared it to brain health terms such as “Alzheimerʼs”

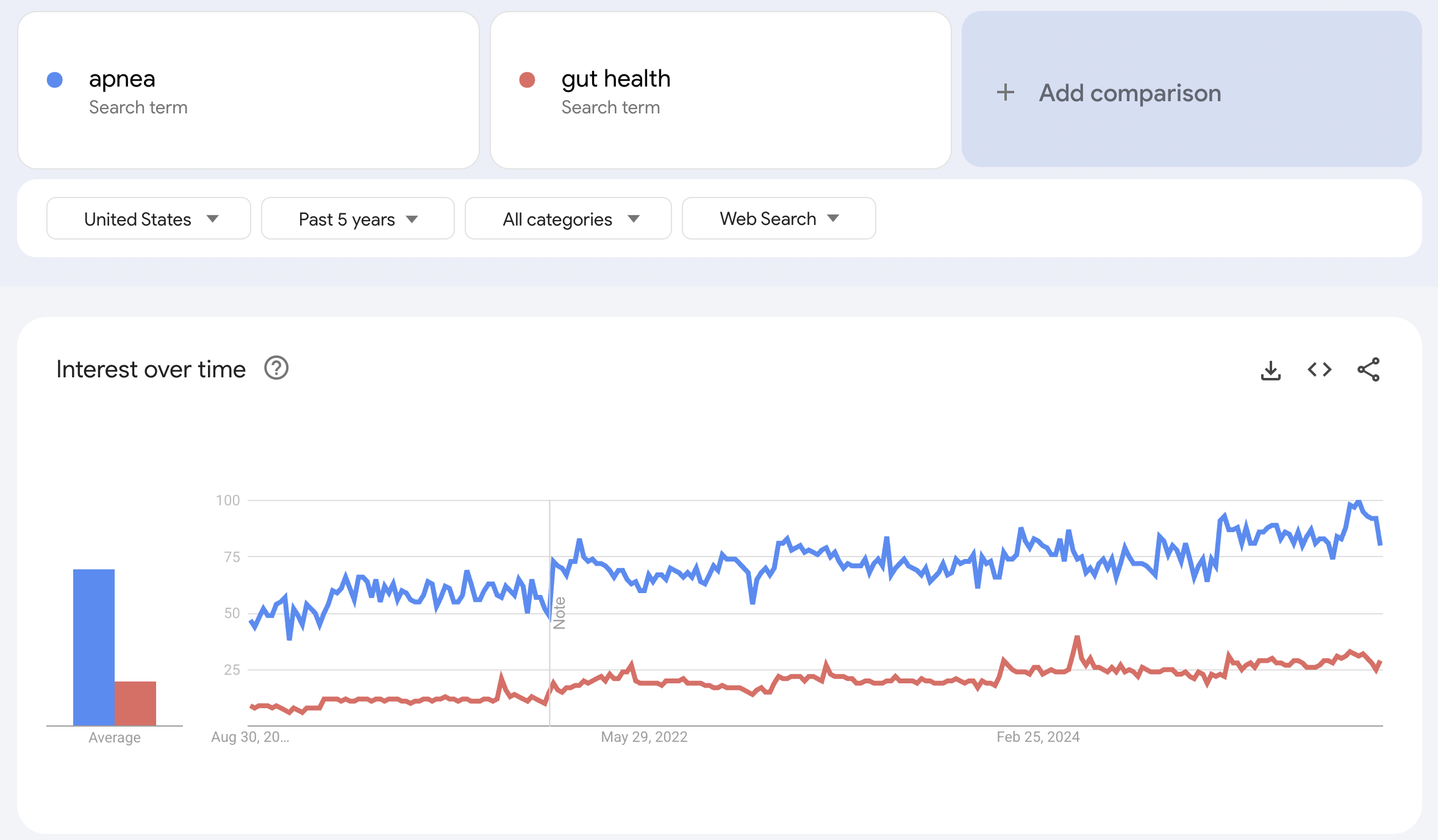

or “apnea,”

which far outpace gut health.

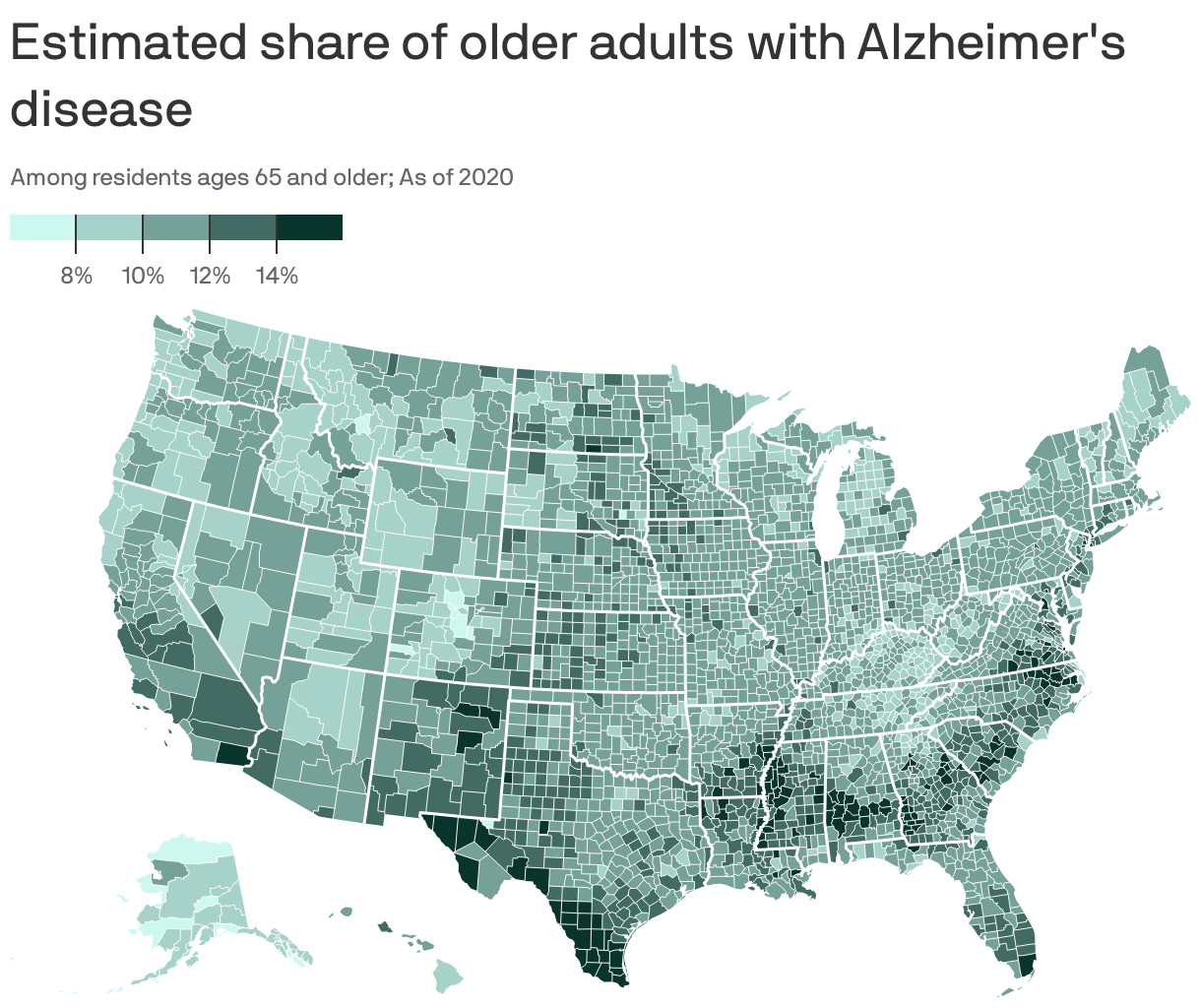

2. Huge, underserved population

Dementia affects over 7 million Americans — nearly 1 in 10 over age 65. Alzheimerʼs disease accounts for 60–70% of these cases, making it the most common and costly form. Dementia care costs are projected to reach $384B in 2025 and close to $1T by 2050.

For context, top risk factors for Alzheimerʼs:

- APOE4 genetics (2–12x risk depending on copies)

- Age (the prevalence roughly doubles every 5 years after age 65)

- Modifiable midlife risks such as hypertension, diabetes, smoking, hearing loss, and obesity.

Among these, sleep apnea is a leading factor.

Sleep apnea affects ~30M Americans, with 80% undiagnosed.

These two conditions are tightly linked: untreated apnea deprives the brain of

oxygen during sleep, driving inflammation and plaque buildup.

As a result, apnea raises dementia risk by 28–45% (1, 2)and can accelerate cognitive decline by up to 12 years — making sleep a direct lever in brain health and Alzheimerʼs risk.

3. First real treatment approvals

In just 2 years, the FDA approved the first disease-modifying Alzheimerʼs drugs (Leqembi,Donanemab), the first-ever medication for moderate-to- severe sleep apnea in adults with obesity (Zepbound), and the first blood- based diagnostic test for Alzheimerʼs (pTau217/β-Amyloid 1–42 Plasma Ratio).

Previously barely treatable brain conditions are now entering the treatment era.

Still, disease-modifying drugs only exist for early Alzheimerʼs; mid-to-late stages remain reliant on symptom control.

4. Structural demand and payer coverage

- Medicare already reimburses anti-amyloid therapies and monitoring.

- Insurers cover CPAP (Continuous Positive Airway Pressure — the first-line therapy for apnea) and will integrate new apnea drugs.

This creates immediate spend capacity beyond out-of-pocket and wellness markets only.

5. Basic treatment gaps remain unsolved

Current drugs only target early Alzheimerʼs or obesity-linked apnea.

Mid-to-advanced disease, agitation, safety, and caregiver burden remain wide open

— areas where families and employers already spend heavily.

6. A continuum of preventive and supportive solutions is emerging

- Risk mapping: genetic (APOE4) and biomarker testing.

- Prevention and lifestyle modification: sleep, stress, toxins, nutrition, exercise.

- Monitoring: cognitive tracking, EEG, HRV, sleep trackers, saliva/urine biomarkers, blood biomarkers.

- Adjunct interventions: non-invasive brain stimulation, light therapy, neurofeedback, stress modulation, supplements (creatine, omega-3, lithium orotate).

- Frontier therapeutics: senolytics, NAD+ boosters, mitochondrial-targeted drugs.

Brain health is shifting from awareness and caregiving to active treatment.

With validated science, regulatory approval, payer coverage, and the emerging proven

links between risk factors, such as apnea, and dementia, now is the moment to

build brain-health solutions that scale across the entire range of solutions — from

risk mapping and prevention to treatment, monitoring, and caregiver support.

Together these create a continuum of solutions — from risk detection to prevention, monitoring, and advanced therapeutics — that extend the impact of new drugs.

Further ideas

1. What prevents scale?

Diagnostic throughput is the biggest bottleneck.

For example, Alzheimerʼs drugs (Leqembi, Donanemab) require proof of amyloid

pathology. That usually means PET scans. PET scans are expensive ($3–5K), in

limited supply, and concentrated in major hospitals. Even if Medicare pays, there

arenʼt enough scanners or trained personnel to process millions of new patients.

2. Where is the spend already happening?

-

Informal caregiving: Families in the U.S. provide ~15B hours of unpaid dementia care annually, valued at ~$300B. Thatʼs money not flowing into structured solutions.

-

Formal care: Dementia is the #1 driver of nursing home placement; Alzheimerʼs alone costs ~$360B/year.

-

Employers: Caregiving reduces productivity, absenteeism, and retention. AARP estimates U.S. employers lose ~$50B/year from caregiving-related turnover and absenteeism.

-

Sleep apnea: Untreated OSA adds ~$150B/year to U.S. healthcare costs through accidents, cardiovascular disease, and lost productivity.

3. What remains invisible?

- Apnea is the most obvious overlooked risk factor — but not the only one.

- Hearing loss: Midlife hearing loss is estimated to account for ~8% of dementia cases worldwide (Lancet Commission 2020). Hearing aids cut dementia risk by ~50% in recent RCTs.

- Oral health: Periodontitis and chronic gum infections accelerate systemic inflammation; strong associations with dementia risk.

- Pollution: PM2.5 and traffic-related air pollution accelerate cognitive decline; WHO now recognizes air pollution as a dementia risk factor.

4. How can we solve this?

The real bottleneck is in the drug delivery. Many patients never make it through testing, scans, and therapy.

A very big need is in building the infrastructure that moves people from screening to therapy, bundles therapy + monitoring, and integrates diagnostics into reimbursement.